3 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

3 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Blog Article

The 7-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs - An OverviewThe Best Guide To Mileagewise - Reconstructing Mileage LogsAbout Mileagewise - Reconstructing Mileage LogsThe Single Strategy To Use For Mileagewise - Reconstructing Mileage LogsSome Ideas on Mileagewise - Reconstructing Mileage Logs You Should KnowThe Main Principles Of Mileagewise - Reconstructing Mileage Logs

We'll study each even more. Organization mileage trackers are important to a cents-per-mile compensation program from a couple simple reasons. Workers will not receive their repayments unless they send gas mileage logs for their company journeys (mileage tracker app). Second, as previously stated, while manually videotaping mileage is an alternative, it's time consuming and exposes the business to mileage fraudulence.FAVR reimbursements are particular to each private driving employee. With the best company, these rates are computed via a system that connects business mileage trackers with the data that guarantees reasonable and exact mileage repayment.

This corroborates the allocation amount they get, guaranteeing any kind of amount they get, up to the Internal revenue service mileage price, is untaxed. This also safeguards firms from prospective gas mileage audit risk., likewise referred to as a fleet program, can't perhaps have need of a business mileage tracker?

Excitement About Mileagewise - Reconstructing Mileage Logs

, "An employee's individual usage of an employer-owned car is taken into consideration a component of an employee's taxable earnings" So, what occurs if the employee does not keep a record of their business and individual miles?

The majority of company mileage trackers will certainly have a handful of these features. At the end of the day, it's one of the greatest advantages a firm gets when adopting an organization gas mileage tracker.

An Unbiased View of Mileagewise - Reconstructing Mileage Logs

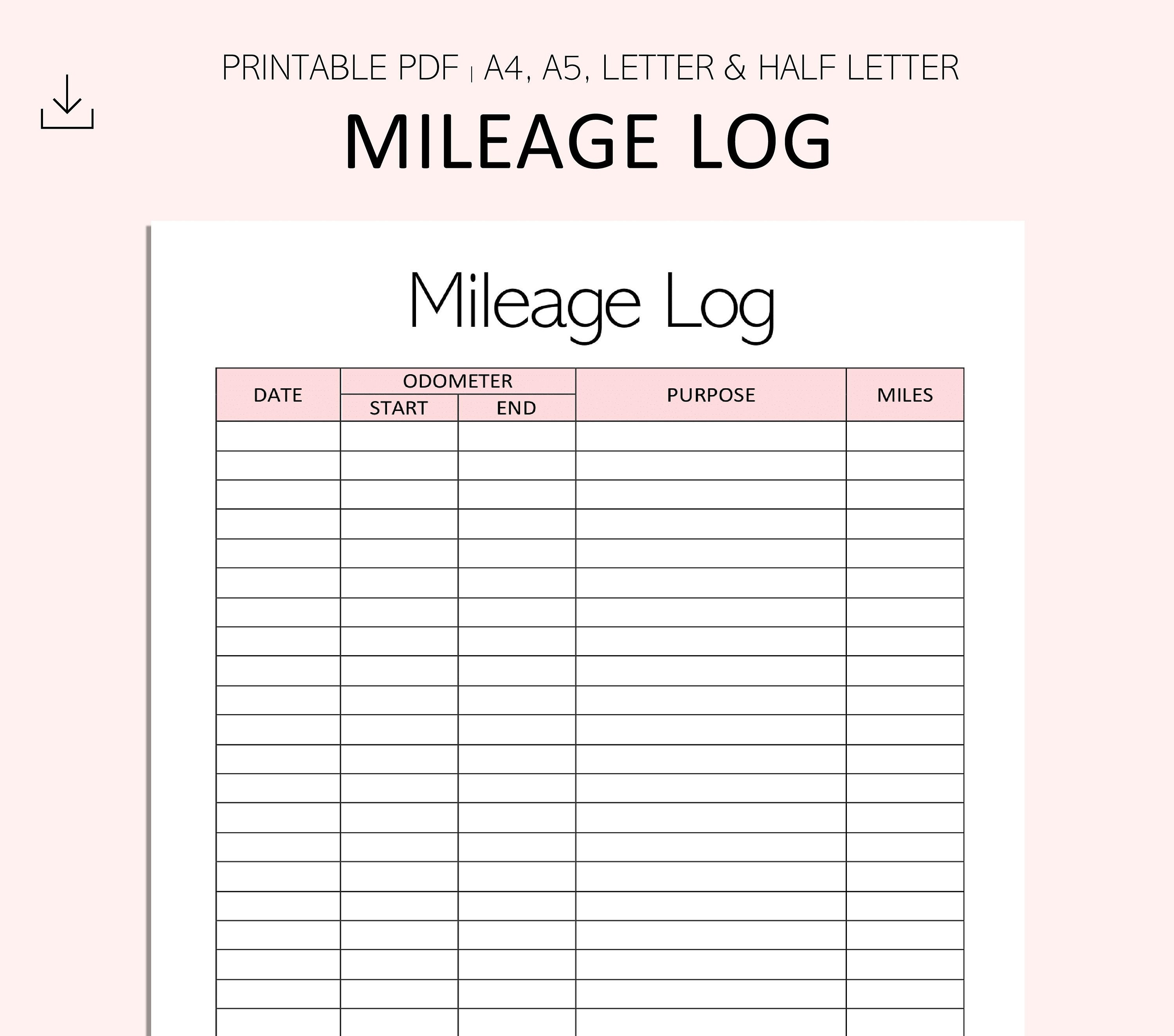

(https://issuu.com/mi1eagewise)If the tracker enables employees to send insufficient mileage logs, after that it isn't doing as needed. Areas, times, odometer document, all of that is logged without additional input.

Submitting gas mileage logs with a company gas mileage tracker ought to be a wind. Once all the info has actually been added appropriately, with the best tracker, a mobile employee can send the mileage log from anywhere.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Can you imagine if a service mileage tracker app captured every solitary journey? Often mobile workers simply neglect to transform them off. There's no injury in catching personal journeys. Those can quickly be erased before entry. However there's an even less complicated remedy. With the most effective mileage monitoring application, companies can establish their working hours.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

This app works hand in hand with the Motus platform to make sure the precision of each gas mileage log and repayment. Where does it stand in terms of the ideal gas mileage tracker?

Interested in finding out more regarding the Motus application? Take a scenic tour of our app today!.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

We took each app to the field on a similar route throughout our strenuous screening. We checked every monitoring mode and turned off the net mid-trip to try offline mode. Hands-on screening allowed us to take a look at use and establish if the application was easy or tough for staff members to make use of.

: Easy to useAutomatic mileage trackingMinimum tracking speed thresholdSegmented monitoring Easy to produce timesheet reports and IRS-compliant go to website mileage logsOffline mode: Advanced devices come as paid add-onsTimeero covers our list, many thanks to its simplicity of use and the effectiveness with which it tracks gas mileage. You don't need to spend in costly gadgets. Simply request employees to mount the mobile app on their iphone or Android mobile phones and that's it.

Report this page